2022-10-18An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property. There is no VAT in Myanmar.

4 Things You Should Know About The Death Tax Exemption

The empty string is the special case where the sequence has length zero so there are no symbols in the string.

. Best Isa bonds savings and current account rates for 2022. See Portugals corporate tax summary for capital gain rates. Abolished inheritance tax in 2014.

Get 247 customer support help when you place a homework help service order with us. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The list focuses on the main types of taxes.

Agreement to avoid double taxation between Spain and the Soviet Union. Property tax is levied on the gross annual value of property as determined by the local state authorities. 2017-4-6The United Kingdom has one of the largest networks of tax treaties with more than 100 countries.

2022-10-9Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. However CGT will be applicable if the individual. In addition to the above tax treaties China has also entered into tax information exchange agreements TIEAs with a few countries.

Previously HMQ paid zero tax and the State paid for upkeep of various Royal properties. These tax treaties have not yet entered into force as of 30 June 2022. Nigeria Last reviewed 28.

Offer period March 1 25 2018 at participating offices only. Namibia Republic of Last reviewed 02 June 2022 15. 6 to 30 characters long.

Corporate tax individual income tax and sales tax including VAT and GST and capital gains. Spanish gift and inheritance tax regulations have been reformed with effect from 1 January 2015 as a result of a judgement given by the EU. 2022-10-18The tax percentage for each country listed in the source has been added to the chart.

2022-10-19The outdated inheritance tax rules costing families 137330. See Puerto Ricos individual tax summary for capital gain rates. Qatar Last reviewed 21 August 2022 Same as CIT rate.

ASCII characters only characters found on a standard US keyboard. See Portugals individual tax summary for capital gain rates. The indirect tax in Myanmar is commercial tax with the general rate of 5.

There are no net wealthworth taxes in Malaysia. Capital gains are classified as either long-term or short-term capital gains. 2022-8-31Spains autonomous communities have extensive powers that enable them to pass their own laws regulating different aspects of this tax and many autonomous communities have established significant tax relief.

Cash savings being eaten alive by record-high inflation. These conventions aim to eliminate double taxation of income or gains arising in one territory and paid to residents of another territory. Relation between the tax revenue to GDP ratio and the real GDP growth rate average rate in years 20132018 according to List of countries by real GDP growth rate data mainly from the World Bank.

They work by dividing the tax rights each country claims by its domestic laws over the same income and gains. Puerto Rico Last reviewed 08 September 2022 20. Netherlands Last reviewed 01 July 2022 21.

2 days agoA comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. 2022-5-25Alphabetical list of countries. 1 day agoCapital Gains Tax is a tax on the profit realized on the sale of a non-inventory asset.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Polish gift and inheritance tax may be imposed on assets and property rights located abroad if the heir or donee is a Polish national or is a Polish permanent resident at the time. New Zealand Last reviewed 21 July 2022 Goods and services tax GST.

Learn the specific estate planning documents you need to protect yourself and your loved ones. There are virtually millions. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift.

May not be combined with other offers. Any asset which is received as a gift by way of will or inheritance is totally exempted from the Online Income Tax Act 1961. 2022-6-10Polish gift and inheritance tax is levied on the value of assets and property rights located in Poland that are transferred on death to an heir and on lifetime gifts.

You get more out of the web you get more out of life. 2022-6-13The rate of both sales tax and service tax is 6. Instrument of Ratification of the Agreement between the Government of Spain and the Government of the Union of Soviet Socialist.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Best in class Yahoo Mail breaking local national and global news finance sports music movies. There are no inheritance estate or gift taxes in Malaysia.

Nicaragua Last reviewed 01 July 2022 15. 2022-6-255 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions. 2022-9-13This is exactly why the provision was made in the 1993 act.

Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. New Zealand abolished estate duty in 1992. Romania Last reviewed 04 August 2022.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. 2 days agoThe annual exclusion applies to gifts to each donee. The VAT burden is generally shouldered by the tenants.

Tax revenue as percentage of GDP in the European Union. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. No other taxes are imposed on income from petroleum operations.

Must contain at least 4 different symbols. Inheritance estate and gift taxes. The trade-off was made that the monarch would look after the properties using the income.

2022-6-30The tax treaty with the former Federal Republic of Yugoslavia is now applicable to the nations of Serbia and Montenegro. 2022-6-13Income tax exemption at a rate of 70 to 100 for a period as determined by the Minister applications received by 31 December 2022. 2022-10-17Plan for your future today.

An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Income tax exemption equivalent to a rate of 60 to 100 of QCE incurred to be utilised against 100 of statutory income and within a period as determined by the Minister applications received by 31 December 2022.

Inheritance And Capital Gains Taxes Draws More Harm Than Benefits

Expat Home Mm2h Benefits Of Joining Mm2h Programme Tax Exemption Your Foreign Sourced Income Or Pension Brought Into Malaysia Is Not Subject To Tax Moreover There Is Also No Inheritance Tax In

Inheritance Tax Rates In G7 And Eu Countries Ten Times Higher Than Emerging Economies Uhy Internationaluhy International

Inheritance Tax Hhq Law Firm In Kl Malaysia

Guan Eng Capital Gains Tax Makes Malaysia Less Competitive So Dap Says No

Tax Data Tax Foundation Your 1 Resource For Tax Data Research

Simple Tax Guide For Americans In Malaysia

1 065 Inheritance Tax Stock Photos Free Royalty Free Stock Photos From Dreamstime

Cover Story Will We See New Taxes On Inheritance And Capital Gains The Edge Markets

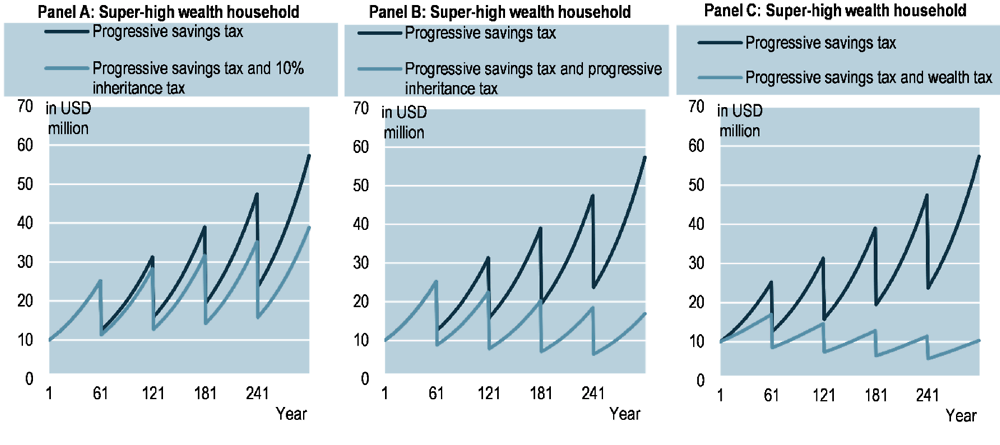

2 Review Of The Arguments For And Against Inheritance Taxation Inheritance Taxation In Oecd Countries Oecd Ilibrary

保险的价值 When Some One Pass Away Our Asset Including Bank Account Etc Will Be Frozen By Government Our Family Need To Pay Inheritance Tax Before We Can Claim

More On Gifting And Estate Taxes Htj Tax

Determining Status For Estate Tax Purposes Htj Tax

Estate And Inheritance Taxes Around The World Tax Foundation

What Happened To The Expected Year End Estate Tax Changes

Lim Guan Eng On Twitter With Malaysia Recording One Of The Highest Corporate Tax Rates Amongst The 60 Biggest Economies Of The World The Government Must Realise That The Country Is Facing

Govt Does Not Intend To Impose Inheritance Tax In Budget 2020 The Star